A multibillion dollar industry that consists of

Dyes, Pigments and Intermediates.

In Global Dyestuff industry, an impressive growth has been seen over the

years. This industry includes three sub-segments namely Dyes, Pigments, and

Intermediates. The dye intermediates are essential derivatives of petroleum

products which after further processing gets transformed into finished dyes

and pigments.

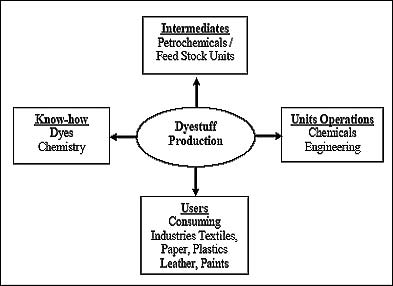

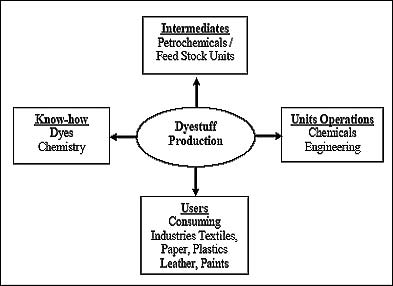

The dye and dye intermediaries industry is now an integral part of a huge

number of industries. Be it chemical, of which it has a substantial stake,

along with that it also provides inputs to a large number of other major

industries like textiles, leather, plastics, paints, paper and printing

inks, pharmaceuticals to name a few. The following diagram highlights how

the Dyestuff industry's interconnection with other facets of the industrial

setup:

In 2005, the global market size for dyes, pigments and intermediaries was

estimated at around $23 billion. If we see the total volume, then global

dyestuff production is estimated to be somewhere around 34 million tonnes.

The annual global sales of textile dyestuff alone is estimated approximately

around $ 6 billion. One of the major factors that had emerged within the

last few years is that the major production centres for dyestuff has shifted

from the west to the east. The global dye manufacturing industry originally

dominated by suppliers from Europe namely UK, Switzerland Germany, has

shifted to Asia over the past 20 years or so. This is primarily because of

two reasons. First, due to much lower costs of production in the Asia

region. Secondly Asia's growing prominence as the hub for global textile

industry.

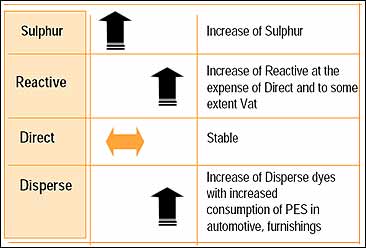

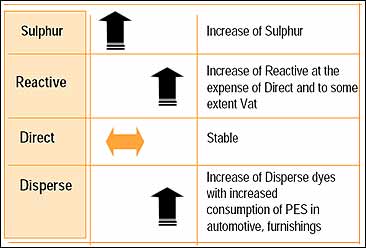

The markets for the dyes are predominantly dominated by reactive and

disperse dyes. In fact the demand for these two dyes is expected to grow in

future also. Nations like China, South Korea and Taiwan are strong players

in the field of disperse dyes. Interestingly, India has taken lead in

production of reactive dyes because of the availability of an intermediate

called vinyl sulphone in the country. The following diagram illustrates the

expected trends of some of the prominent dyes.

China's share in the world market is estimated to be around 25%. Along with

China, Taiwan, India, Japan and Pakistan are among the major dyestuff

producing countries in the industry. But in terms of the sheer volume of

market share, Europe is the leading. This is due because of its allegiance

towards specialty products. The global market share of Indian dyes industry

is between 5 - 7%, and it is continuously increasing year by year.

Though an impressive growth has been seen in

Global Dyestuff Industry, but still this industry is facing some serious

challenges. And these challenges are:

Environmental Considerations- The thrust is now towards the

environment friendly natural dyes. The industry can only prosper if the dyes

are not hazardous and environment friendly. A very good example is the

banning of the Azo dyes in Europe along with closure of the units.

Support of the Government and Trade Association- Any industry that

moves ahead needs the back-end support of the government as well as the

trade associations. This helps to promote that industry in other countries,

allocation of investments and giving other supports. These associations

should actively promote technology institutes that does research activities.

Problem of over capacity but falling margins- It is a fact that

China and India now have high potential as regards production capacity is

concerned. This is due to a shift in the manufacturing bases from Europe and

some other industrialise nations. But there is varying demand across these

regions and that is the cause for volatility in the market. Thus affecting

prices.

Fierce competition- Again, because of the shift of companies from

West to East has resulted in concentration of all the companies in the Asian

region which has created intense competition in the global market.

Research & Development- Market demands a higher spending for

innovation in products like natural dyes.

Product quality vis-a-vis competitive prices- Manufacturers should

focus on the quality of products along with competitive prices for retaining

market. The production share of the developed countries in the market has

gone down from 65% to around 50% and this is further expected to reduce in

future.

Classification of products and services- A decline in the growth for

products has prompted the manufacturers to move to specialty products.

High cost of energy and interest- The exorbitant cost of interest

can lower the investment in R&D which is at the core of product and

service innovations. Also, the high energy cost has also adversely impacted

the manufacturing units.

Availability of World Class Infrastructure- As ports and roads are

the primary sources of transport, the Governments must emphasis to improve

the clearance of the goods at a quicker rate to facilitate trade.

![]() Profile

Profile ![]() Product Range

Product Range![]() Industries

Industries![]() Infrastructure

Infrastructure![]() Our Quality

Our Quality![]() Custom Manufacturing

Custom Manufacturing![]() Network

Network![]() Contact Us

Contact Us![]() Send Enquiry

Send Enquiry

![]() Profile

Profile

![]() Product

Range

Product

Range![]() Industries

Industries![]() Infrastructure

Infrastructure![]() Our

Quality

Our

Quality![]() Custom

Manufacturing

Custom

Manufacturing![]() Network

Network![]() Contact

Us

Contact

Us![]() Send

Enquiry

Send

Enquiry